Gold Vs. Bitcoin: Who You Got?

Investment Thesis

Over the past few years, an increasingly wide range of cryptocurrencies have come into existence. Bitcoin is a very recent innovation of cryptocurrencies.

In the comparative analysis that will follow, we will unfold each of their respective advantages and disadvantages by comparing and contrasting bitcoins against gold.

Each of these two has unique investment characteristics in consideration of five parameters namely, durability, intrinsic value, price volatility, portability and divisibility.

This article will also let us judge, which of the two is a better investment choice. Bitcoin being a speculative financial asset faces the challenge as a store of value due to vulnerable monetary policy decisions. Gold never fails being a store of value and a rare commodity.

Gold and Bitcoins

1. Durability

Gold seems to win out against bitcoins in durability. Both of them require some level of expertise to keep them for a long time. However, correct long-term storage and security is extremely challenging for several reasons.

Bitcoins are vulnerable to hacking. MyBitcoin.com (an online wallet) had approximately 51% of its bitcoins stolen at an estimated value of $49 million. To date, the biggest bitcoin hack was done in the online currency exchange Mt. Gox. Rampant thefts reported from 2011 until its closure in 2014 which took $500 million worth of bitcoins.

There are significant regulatory risks surrounding bitcoins. Many regulators have expressed concerns over bitcoins and the related field of Initial Coin Offerings (ICO), given the short history of the technology and its inherent abilities to audit "Know Your Customer" (KYC) and Anti Money Laundering (AML) legislation.

Bitcoins are also subject to network or infrastructure risk. Bitcoins work on blockchain technology which is "splitting" the internet into two infrastructure. There is still an inherent risk to bitcoins if the internet were ever to "split". It would be possible for bitcoin holders to "double spend" the same bitcoin.

2. Intrinsic Value

Gold is not subject to competition from alternatives, while bitcoins are. Rarity is electronically built into the codes of cryptocurrencies. This would again appear to make bitcoins the better choice over gold, as limited supply is a mathematical certainty. Gold has a limited supply in the earth's crust. However, a key property of all precious metals is that they are "elements".

Elements are not invented, they are discovered, and we have already discovered all the elements neighboring the precious metals. It is impossible that an "alternative" precious metal will ever emerge in the earth's crust.

Hence, there is no control over the supply of bitcoins at a macroeconomic level. Bitcoins can multiply into "alternatives'', and it has a high potential of substitutability to its original form. It has no intrinsic value due to rarity unlike gold.

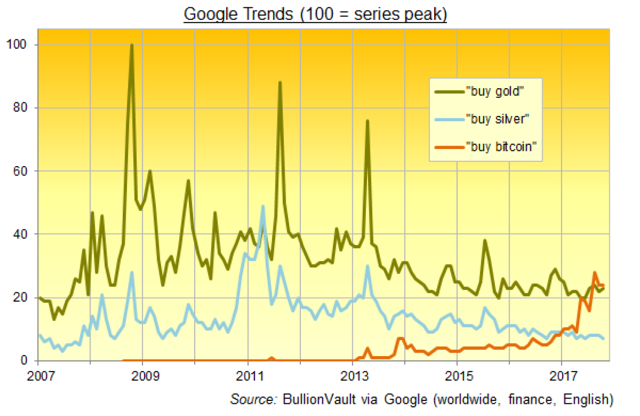

The data below were gathered from Google Trends. It shows the number of internet searches for the phrase "buy gold", "buy silver" and "buy bitcoins". Search for "buy bitcoins" seems to be fast catching up lately with the other two.

Source: BullionVault

3. Price Volatility

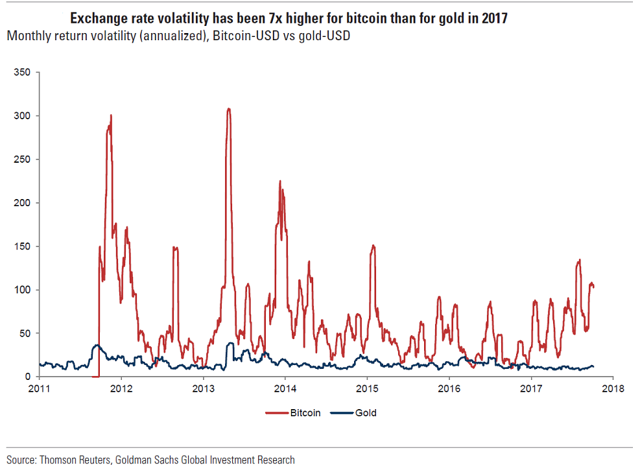

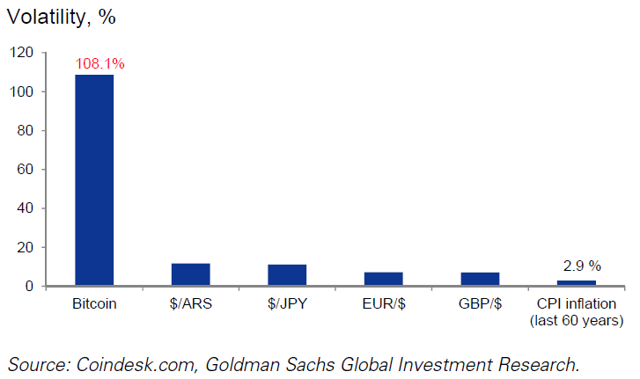

Gold has a long history of maintaining its purchasing power. Bitcoin fails to maintain price stability historically. The extreme volatile exchange rate of bitcoin necessitates a bigger risk premium in order to hedge forex risk.

Simply put, a seller who accepts bitcoins for transactions, will require him to change it into US dollars the following day. After which, he waits further two days for clearance. Taken all together, a risk premium of approximately 2.3% will be needed to hedge forex risk.

The table below shows that Bitcoin/USD volatility averaged almost 7 times that of gold in 2017:

Source: Thomson Reuters, Goldman Sachs Global Investment Research

4. Portability

Transferring gold can be expensive given its weight, high import taxes (such as in India), the need for a high level of security. In contrast, since there is no need to make a physical transfer with bitcoin - just a transfer of ownership in a distributed database called blockchain (which is already held digitally by computers all over the world). It is much faster and less expensive to move bitcoins.

5. Divisibility

Gold physical transfers usually only occur for larger values, with transactions typically occurring in 400 tonnes per ounce (or 11.3kg) or 1kg bars. The smallest Bitcoin unit is 1 satoshi.

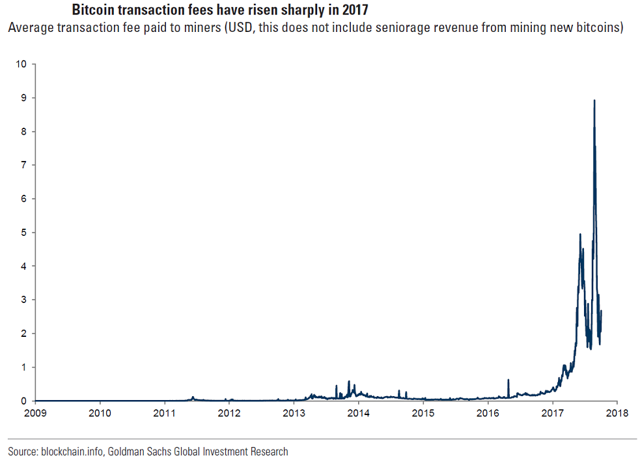

The currency is close to infinite divisibility with 100 million satoshis for each bitcoin. This makes bitcoins seem a much better candidate from the perspective of divisibility. However, much higher transaction fees were being charged for bitcoin users with average transaction fee growing to more than $2 since mid-2017, as compared with less than 1 cent charged in previous years.

The chart below exhibits the trend for average transaction fees paid to cryptocurrency miners:

Our Takeaway

We prefer to endorse gold to investors, given a number of factors cited in this comparative analysis.

Gold has pure intrinsic value due to its rarity. There is a long history of unregulated currencies. Gold has been an unregulated currency at various times and in various places.

Investors always get to an unregulated currency. There is a government that regulates but it does not control the money supply very well. In some occasions, a number of investors do not trust the official currency. Bitcoin just seems to be another version of this. It is a lot like gold, in fact. Obviously, the difference is bitcoin is digital rather than a heavy, unwieldy object.

That means that bitcoins could serve the same purposes as gold in terms of a currency. It does not have any mass and can be sent easily from place to place.

In terms of price trends, it is also less volatile than bitcoins. Gold price never dropped 40%, which bitcoin has - on a couple of occasions last year. Unlike gold, bitcoin also has no fundamental value from alternative uses that could anchor its price.

This does not mean that the value of bitcoin might not rise over time. If demand grows against a finite supply, it will happen. But without an issuer who could guide price changes, or an alternative valuable use, the notion that its value will be stable is harder to envisage. The lack of these two foundations may end up to bitcoin's price more susceptible to self-fulfilling price dynamics.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article was written by Hans Centena, our business journalist. Gold News is not a registered investment advisor or broker/dealer. Readers are advised that the material contained herein should be used solely for informational purposes. Investing involves risk, including the loss of principal. Readers are solely responsible for their own investment decisions.

Source: seekingalpha.com